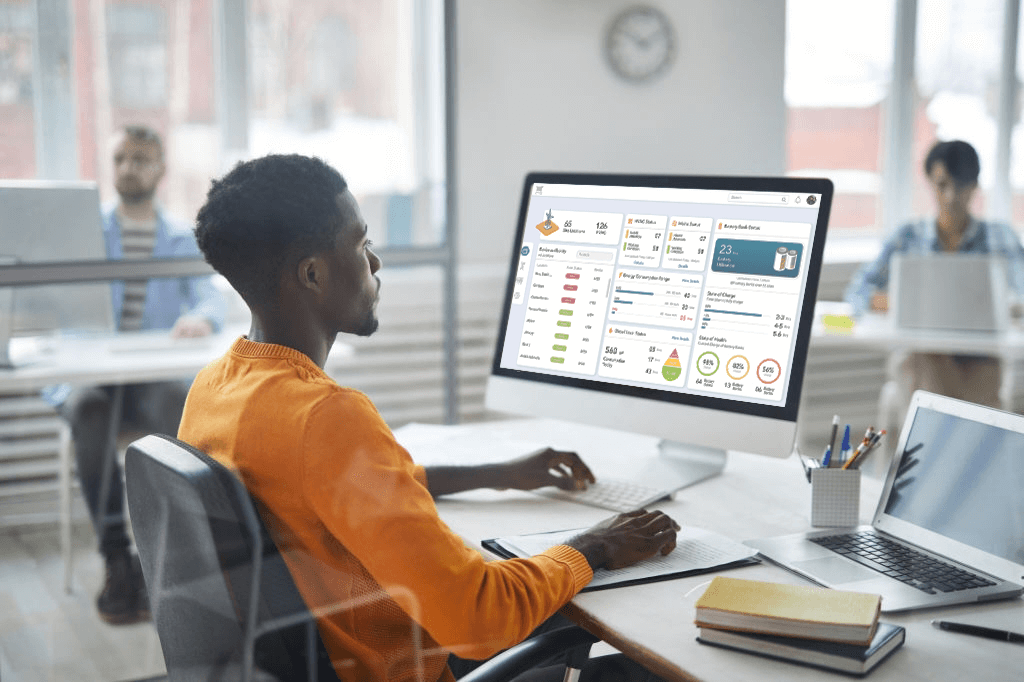

Just as it is for customers and other businesses, the Internet of Things (IoT) is an indispensable and growing resource for the insurance industry. Current predictions suggest that by 2020, smart sensors and other IoT devices will generate at least 500 zettabytes of data.

These advancements in IoT open doors of opportunities for insurers: to develop new products, open new distribution channels, and extend their role to include prediction, prevention, and assistance.

Smart monitoring devices allows insurers to improve security, enhance health and safety and optimize administrative processes.

Again, they are faced with the problem of complexity and a high upfront capital requirement to launch their own IoT solutions. There is also the constraint of time to deploy IoT networks. There is also the constraint of time to deploy IoT networks.

Comply to Health, Safety and Environment (HSE) regulations

• Detect fire before it escalates.

Application of IoT for Security

• Signal for immediate response in case of emergencies.

• Monitor against unauthorized access to restricted properties.

• Track assets in real-time.

Optimize Processes for Better Administrative Planning

• Real-time staff attendance monitoring.

• Monitor staff presence.

• Monitor staff productivity and interaction with customers.

• Get feedback on customer satisfaction with the services rendered.

Again, they are faced with the problem of complexity and a high upfront capital requirement to launch their own IoT solutions. There is also the constraint of time to deploy IoT networks. There is also the constraint of time to deploy IoT networks.